Student-centric advice and objective recommendations

Higher education has never been more confusing or expensive. Our goal is to help you navigate the very big decisions related to higher ed with objective information and expert advice. Each piece of content on the site is original, based on extensive research, and reviewed by multiple editors, including a subject matter expert. This ensures that all of our content is up-to-date, useful, accurate, and thorough.

Our reviews and recommendations are based on extensive research, testing, and feedback. We may receive commission from links on our website, but that doesn’t affect our editors’ opinions. Our marketing partners don’t review, approve or endorse our editorial content. It’s accurate to the best of our knowledge when posted. You can find a complete list of our partners here.

All About Income-Driven Repayment Plans

By

Kayla Korzekwinski

By

Kayla Korzekwinski

Kayla Korzekwinski is a Scholarships360 content writer. She earned her BA from the University of North Carolina at Chapel Hill, where she studied Advertising/PR, Rhetorical Communication, and Anthropology. Kayla has worked on communications for non-profits and student organizations. She loves to write and come up with new ways to express ideas.

Full BioLearn about our editorial policies

Maria Geiger is Director of Content at Scholarships360. She is a former online educational technology instructor and adjunct writing instructor. In addition to education reform, Maria’s interests include viewpoint diversity, blended/flipped learning, digital communication, and integrating media/web tools into the curriculum to better facilitate student engagement. Maria earned both a B.A. and an M.A. in English Literature from Monmouth University, an M. Ed. in Education from Monmouth University, and a Virtual Online Teaching Certificate (VOLT) from the University of Pennsylvania.

Full BioLearn about our editorial policies

The U.S. federal government offers four income-driven repayment plans (IDR) as alternatives to the standard 10-year repayment plan. The income-driven repayment plans base monthly payments on your annual income. If your monthly student loan payments are too high, one of these plans may help you get a lower amount. Payments can even be as low as $0! Continue reading to learn all about income-driven repayment plans.

Also read: Best student loan repayment plans

What is an income-driven repayment plan?

An income-driven repayment plan (IDR) allows borrowers with federal student loans to adjust their monthly payment based on their income and family size. If your monthly student loan payments are too high, one of these plans may help you get a lower monthly payment amount!

Similarities between different income driven repayment plans

Each IDR plan has its own qualifications and limits. However, they all share some similarities.

Application

All four of the IDRs require an application to enroll. This IDR application can be found through the Department of Education. The process takes about 10 minutes.

The application requires certain documentation in order to calculate monthly payments. First, you’ll need to provide a transcript of your most recent income-tax return. If you didn’t file taxes, you can provide documentation in the form of pay stubs, a letter from your employer outlining your income, or a signed letter describing your gross pay. Second, you must provide information about your family size. This information will be used to calculate your monthly payments.

Your loan servicer can place your loans in deferment while your application is being processed. Interest will still accrue during that time.

Learn more: How much student loan debt is too much?

Payment cap

Another similarity between all of the IDRs is that monthly payments are capped at a portion of annual income. The limit varies between plans, but it is either 10% or 20%.

Recertification

The amount you pay on an IDR can change year to year. This is because, on each plan, you must recertify your income and family size. This process must be done annually, or there are consequences. The consequences include capitalizing interest and being moved back to the standard 10-year repayment plan.

The recertification process is quick and easy. Just go to the same page as the IDR application and fill out the form again. When filling out the application, indicate that you are recertifying. Your loan servicer will remind you when the deadline is approaching.

Related: How to recertify your income based repayment plan

Forgiveness

All IDRs offer forgiveness of the remaining loan balance after the repayment period. The repayment period is either 20 or 25 years, depending on the plan.

This offer of forgiveness is enticing, especially if you have a large balance. However, you may end up paying off your loan before the repayment period ends. Also, keep in mind that you’ll pay more in interest over time on all of these plans.

Related: All you should know about student loan forgiveness

Defaulted loans

The final similarity between all 4 IDR plans is that they cannot be used for defaulted loans. Borrowers must get their loans out of default before enrolling in an IDR.

See also: Student loan default: how to get out of it

Types of income-driven repayment plans

The U.S. department of education offers four income-driven repayment plans:

- Saving on a valuable education (SAVE) plan

- Pay as you earn (PAYE)

- Income-based repayment (IBR) plan

- Income-contingent repayment (ICR) plan

Saving on a Valuable Education (SAVE)

The SAVE Plan is the news IDR plan for federal student loans. Under SAVE, your monthly payment amount is based on your discretionary income which is the difference between your adjusted gross income (AGI) and 225% of the U.S. Department of Health and Human Services Poverty Guideline amount for your family size.

Additionally, the SAVE plan eliminates 100% of remaining monthly interest for both subsidized and unsubsidized loans after you make a full scheduled payment. This will prevent any unpaid interest from accruing which can prevent furthering your debt amount.

The SAVE plan also excludes any spouse’s income from being considered for your total income if you file separately. This results in a simpler application process and typically a greater amount of aid than if you had to be considered based on both incomes.

Pay As You Earn (PAYE)

The PAYE plan has monthly payments that are capped at 10% of your annual income. The payment period is 20 years. PAYE can only be used on federal Direct loans.

Under PAYE, monthly payments will never be more than what you would have paid on the standard 10-year plan. If at any point your income increases so that you would pay more than the standard plan, you will remain in PAYE but you will pay based on the 10-year plan.

Therefore, you cannot enroll in PAYE if your monthly payments on the plan would be higher than the 10-year plan. Generally, you can qualify for PAYE if your debt is a significant portion of your annual income. Also, to enroll in PAYE, you must be a new borrower. This means you must have not had an outstanding balance on a Direct or FFEL loan on or after October 1, 2007. You must also have received a disbursement of a Direct loan on or after October 1, 2011.

PAYE may be a good fit if you have graduate/professional school loans or you have low earning potential. Another important thing to note about PAYE is if you’re married, and you and your spouse file taxes jointly, your spouse’s income will be factored into your monthly payments. If you file taxes separately, payments will be based only on your income.

Also read: Navigating different types of student loans

Income-Based Repayment (IBR)

The Income-Based Repayment plan caps monthly payments at 10% of annual income if you are a new borrower on or after July 1, 2014, meaning you had no outstanding loan balance. If you are not a new borrower on or after July 1, 2014, the monthly payment is 15% of annual income. The payment period is 20 years for new borrowers, or 25 years for those who are not new borrowers. IBR is different from PAYE and REPAYE because it can be used to pay FFEL loans as well as Direct loans.

Like PAYE, you can only enroll in IBR if your monthly payments would be less than what you would have paid on the standard 10-year plan. If your income increases to the point that monthly payments would be more than the standard plan, you will remain in IBR, but pay based on the 10-year plan.

IBR is a good fit if you don’t qualify for PAYE or have FFEL loans.

Income-Contingent Repayment (ICR)

On the Income-Contingent Repayment plan, monthly payments are the lesser of 20% of annual income or what you would pay on a 12-year plan with a fixed payment that is adjusted according to income. ICR has a 25-year payment period.

This plan can be used on all Direct student loans. It is also the only plan that allows you to pay parent PLUS loans. The parent PLUS loans must first be consolidated into a Direct consolidation loan.

Payments under ICR are always based on income and family size. So, there is a chance that you could pay more monthly under this plan than the standard plan. This plan is ideal if you are a parent looking to pay off PLUS loans.

Income-driven repayment plans are a great way to lower your monthly student loan payments and avoid issues such as default. The 4 IDRs have such nuanced requirements that it can be challenging to make a decision. The easiest way to select an IDR that’s best for you is by talking to your loan servicer. They can give advice on which plan would be the best fit for your income and loan balance.

Related: How to lower student loan payments

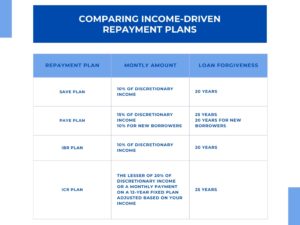

Comparing Income-driven repayment plans

Income-driven repayment advantages

Lower monthly payments

One of the biggest advantages of IDR is that the monthly payments will typically be lower as they are based on your discretionary income. Typically, repayment plans will provide borrowers with the lowest monthly loan payment available. In fact, monthly payments can even be $0 with an IDR.

The remaining balance is forgiven

The remaining student loan balance is forgiven after 20 or 25 years of repayment.

Credit scores are not impacted

Income-driven repayment plans do not hurt borrower’s credit scores. This is important because it means your credit score will not be penalized or affected for having a IDR plan.

Income-driven repayment disadvantages

More interest over time

Income-driven plans can extend the repayment time period from the standard 10 years to 20 or 25 years. Therefore, if you are paying your loan for a longer amount of time then more interest will accrue on your loans.

Taxes on the forgiven balance

If you have a balance left at the end of the repayment term, the forgiven amount will normally be taxed as income. However, if you qualify for Public Service Loan Forgiveness, you will not be taxed by the federal government but you may be taxed by your state.

Spouse’s information can factor in

If you are married your spouse’s information may be factored into your student loan payment amount. Be sure to check if your income-driven repayment plan will use your income or a combined income.

Frequently asked questions about income driven repayment

How long can you be on an income-driven repayment plan?

What is the difference between income-driven and income-based repayment?

Are student loans forgiven after 20 years of repayment?

When am I required to recertify my income for my IDR plan?