Student-centric advice and objective recommendations

Higher education has never been more confusing or expensive. Our goal is to help you navigate the very big decisions related to higher ed with objective information and expert advice. Each piece of content on the site is original, based on extensive research, and reviewed by multiple editors, including a subject matter expert. This ensures that all of our content is up-to-date, useful, accurate, and thorough.

Our reviews and recommendations are based on extensive research, testing, and feedback. We may receive commission from links on our website, but that doesn’t affect our editors’ opinions. Our marketing partners don’t review, approve or endorse our editorial content. It’s accurate to the best of our knowledge when posted. You can find a complete list of our partners here.

How Much Student Loan Debt is Too Much?

By

Will Geiger

By

Will Geiger

Will Geiger is the co-founder of Scholarships360 and has a decade of experience in college admissions and financial aid. He is a former Senior Assistant Director of Admissions at Kenyon College where he personally reviewed 10,000 admissions applications and essays. Will also managed the Kenyon College merit scholarship program and served on the financial aid appeals committee. He has also worked as an Associate Director of College Counseling at a high school in New Haven, Connecticut. Will earned his master’s in education from the University of Pennsylvania and received his undergraduate degree in history from Wake Forest University.

Full BioLearn about our editorial policies

Annie has spent the past 18+ years educating students about college admissions opportunities and coaching them through building a financial aid package. She has worked in college access and college admissions for the Tennessee Higher Education Commission/Tennessee Student Assistance Corporation, Middle Tennessee State University, and Austin Peay State University.

Full BioLearn about our editorial policies

It’s no surprise that students ask themselves how much student loan debt is too much. Across the United States, people owe $1.7 trillion in student loan debt. Consuming a huge chunk of your income, student loan debt can take decades to pay off.

If you are a student who is considering taking out student loans, you will want to be mindful of how much you are borrowing. Luckily, we’ve put together some tips to help you understand how much student loan debt is too much so that you can borrow in a smarter way.

Consider your expected salary

One of the first things students should consider when deciding how much debt they can afford is their expected salary in the first year after graduation. Research the expected annual salary of people with your major. The Occupational Outlook Handbook from the Bureau of Labor allows you to search the median pay and projected growth rate of a number of careers. If you’re undecided on your major, know that the average student loan debt is $37,000 and the average post-grad salary is $40,000.

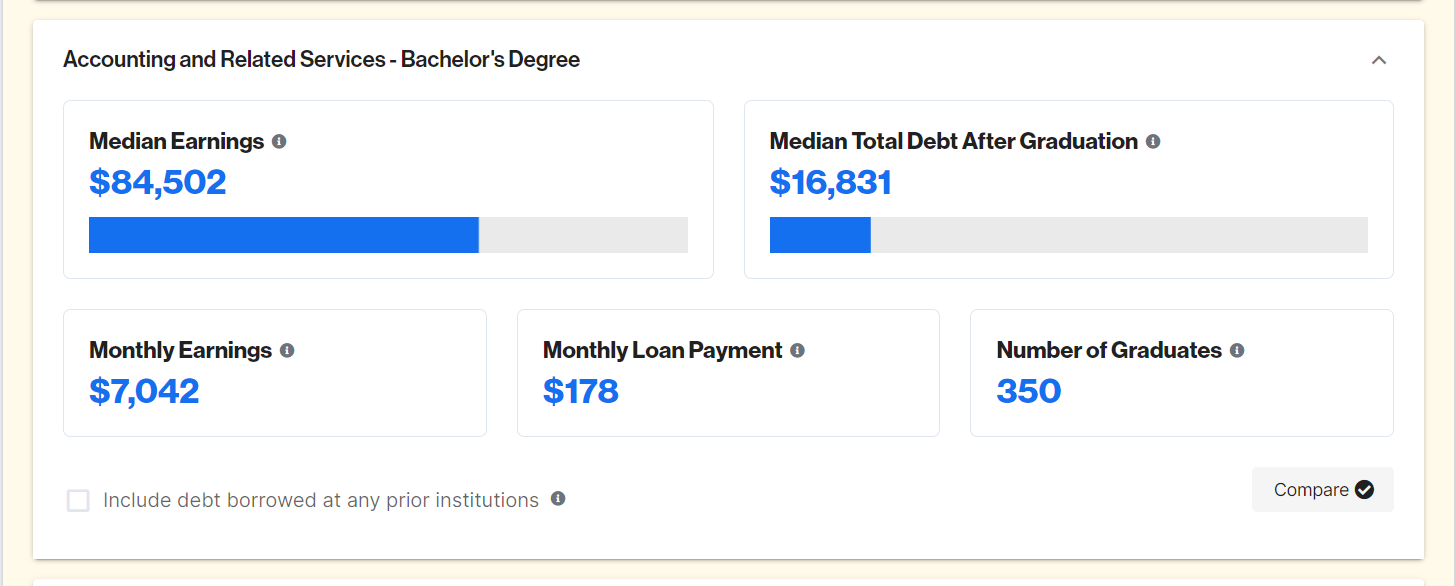

Many schools also offer information on the average salary of graduates. The College Scorecard from the Department of Education provides information on costs, graduation rate, loan default rate, average amount borrowed, and employment rate for a given school. One of the most helpful parts of the College Scorecard is that students can search for median earnings by specific majors at your college. For instance, here is the report for accounting majors at Texas A&M – College Station:

This information will help you make a smarter decision that is based on your academic goals. We recommend that you use the College Scorecard to understand what debt and earnings will look like at all of the schools you are considering.

Students should aim to keep their debt balance below their expected first-year salary. If your total debt is less than your annual income, you will be on track to pay off your debt within 10 years. Another rule of thumb is to keep monthly loan payments at between 8 – 10% of monthly salary. The federal government recommends that student loan debt should not exceed 15% of income.

It’s also important to note that salaries greatly vary depending on the type of career you want to pursue. For example, if your ambition is to work in accounting for a non-profit organization, your earning potential will be very different from an accountant at a multinational accounting firm. This is not to say that one path is better than the other. However, your salary will be different, which is worth considering.

Ultimately, students should treat their college education as an investment and make sure that this investment will result in a positive return.

Consider future educational plans

In addition to your future careers, it is worth thinking about your educational future. This is specifically important for students who are interested in careers in medicine, nursing, law, and other careers that require students to go to graduate school before starting their careers.

If you are an aspiring doctor, you should be mindful of your undergraduate student loan debt, because medical school is an expensive education that requires a sizable amount of student loan debt. So if you plan on going to medical school or law school immediately after undergrad, it may make more sense to attend a more affordable undergraduate option to minimize your student loan debt as your graduate education will be more important for your future career.

Know the details of your loan

Before signing the dotted line, be sure that you know the details of your loan. Take note of the overall balance, interest rate, repayment plan, and repayment flexibility. In general, students should focus on utilizing federal student loans before private student loans. These loans have a lower interest rate, and they offer more relief plans than private loans. Below, we’ll walk through some of the major benefits for borrowers of federal student loans.

Temporary debt relief

If students are having trouble repaying their student loans, the federal government provides some options to help. Student loan deferment allows students to temporarily stop making payments on their student loans, while loan forbearance allows borrowers to stop or reduce payments for up to a year. Remember, students will need to officially request this relief, but the federal government makes it available to all borrowers. This is not necessarily the case for private student loan lenders who are not required to offer these options to students.

Another example of temporary debt relief occurred during the COVID-19 pandemic when the federal government extended a pause on student loan repayment for students who held federal student loans. Students who had borrowed private student loans were not eligible for the loan pause and had to continue to pay back their student loans.

Flexible repayment plans

The federal government also offers borrowers a number of flexible student loan repayment plans, some of which peg student loan repayment options to a percentage of your income. Under many of these plans, students are not required to make payments if their income is below a certain amount.

Student loan forgiveness

Students who borrow federal student loans may also be eligible for student loan forgiveness and student loan discharge. Student loan forgiveness includes programs that benefit students who pursue specific career pathways, including public service careers in the government or for non-profits. Students who participate in certain income-based repayment plans can also be eligible for forgiveness if they have made payments for a certain number of years.

Student loan discharge is available for students who attended colleges that closed or colleges that misled or defrauded students. Discharge is also available in the cases of the death of the borrowers or if the borrower has a permanent disability that prevents them for working.

In August 2022, President Joe Biden announced a student loan forgiveness plan that was ultimately invalidated by the United States Supreme Court. This forgiveness plan aimed to relieve $10,000 to $20,000 of student loan debt for eligible borrowers.

Subsidized student loans

Some students with demonstrated financial need may be eligible for subsidized loans. The biggest perk of these student loans is that the U.S. government will pay the interest in your loans when you are in school at least half-time. On top of this, your interest will be paid for the first six months after you graduate from college.

Remember, not everyone is eligible for federal assistance, and federal loans have a borrowing limit. Be sure to shop around before turning to a private loan and select the lender that best fits your needs.

Set a budget

If you do choose to use student loans to fund your education, be sure to use them wisely. Use student loans for only essential expenses. Try not to include all of your living expenses or recreational expenses in your student loan budget. This is also a great way to start forming good financial habits in the future.

See also: How to create a budget as a college student

How can you reduce your student loan debt

There are several other options for students who are looking to reduce their student loan burden:

Part-time job

Another option is to take on a part-time job while you’re in school. This extra income can allow students to pay for living expenses, like rent or utilities, without taking out more loans. Working can also give you the chance to save up some money for when the time comes to start repayment.

If you’re concerned about balancing a job and your studies, work study is also an option. Work study is offered through most schools, and these jobs are more flexible with students’ school schedule. Many colleges also have a student employment office where students can find part time jobs.

See also: How to make money in college

Choose a more affordable option

Another way to reduce student loan debt is to choose a more affordable college. Public in-state universities, community colleges, and online colleges are great places to start when thinking about affordability. In fact, there are nearly 30 states in the US that offer a version of free community college for students.

Other colleges may offer students generous financial aid and merit scholarships. The Net Price Calculator is a great tool to help students understand the cost of a college before they apply. This can be a helpful way to select colleges for your list that will be affordable.

Negotiate your financial aid

Did you know that you can appeal for more financial aid? This process can allow students to be considered for additional scholarships and financial aid. The specifics of the process will vary from college to college, but is an option to negotiate for more aid.

Scholarships and grants

Research your eligibility for scholarships and grants through your school or other organizations. Many states also offer state-specific scholarships.

Students can also apply for college-specific scholarships once they are in school. For instance, many colleges offer departmental scholarships to students who are studying in a particular major. Many of these scholarships will only be available to students who are sophomores or above. This means that if you do have to take out a small student loan their freshman year, you may be able to replace that with a scholarship in subsequent years.

See also: Scholarships by state

Consider your options while keeping the future in mind

When it comes time to fund your education, it can be hard to imagine where you’ll be in the future. This mindset can cause students to borrow more money than they can afford. When I was a college counselor and advising students, I always encouraged them to think very carefully about the amount of money they intended to take out in student loans.

Overall, the amount of student loan debt one can afford is a personal decision. It can be based on the above factors as well, such as family contribution and the school you go to. If you do plenty of research and consider all your options, you will be well-equipped to make the right moves to fund your education!

Key Takeaways