Student-centric advice and objective recommendations

Higher education has never been more confusing or expensive. Our goal is to help you navigate the very big decisions related to higher ed with objective information and expert advice. Each piece of content on the site is original, based on extensive research, and reviewed by multiple editors, including a subject matter expert. This ensures that all of our content is up-to-date, useful, accurate, and thorough.

Our reviews and recommendations are based on extensive research, testing, and feedback. We may receive commission from links on our website, but that doesn’t affect our editors’ opinions. Our marketing partners don’t review, approve or endorse our editorial content. It’s accurate to the best of our knowledge when posted. You can find a complete list of our partners here.

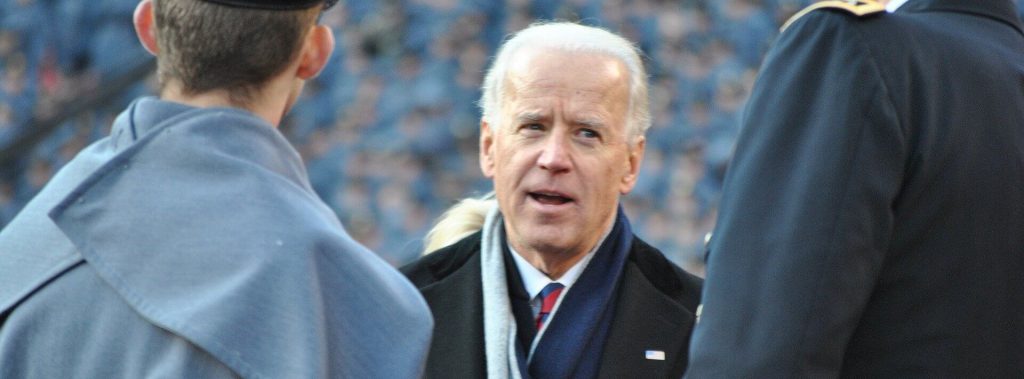

All You Need to Know About Biden Student Loan Forgiveness

By

Gabriel Jimenez-Ekman

By

Gabriel Jimenez-Ekman

Gabriel Jimenez-Ekman is a content editor and writer at Scholarships360. He has managed communications and written content for a diverse array of organizations, including a farmer’s market, a concert venue, a student farm, an environmental NGO, and a PR agency. Gabriel graduated from Kenyon College with a degree in sociology.

Full BioLearn about our editorial policies

Kayla Korzekwinski is a Scholarships360 content writer. She earned her BA from the University of North Carolina at Chapel Hill, where she studied Advertising/PR, Rhetorical Communication, and Anthropology. Kayla has worked on communications for non-profits and student organizations. She loves to write and come up with new ways to express ideas.

Full BioLearn about our editorial policies

Maria Geiger is Director of Content at Scholarships360. She is a former online educational technology instructor and adjunct writing instructor. In addition to education reform, Maria’s interests include viewpoint diversity, blended/flipped learning, digital communication, and integrating media/web tools into the curriculum to better facilitate student engagement. Maria earned both a B.A. and an M.A. in English Literature from Monmouth University, an M. Ed. in Education from Monmouth University, and a Virtual Online Teaching Certificate (VOLT) from the University of Pennsylvania.

Full BioLearn about our editorial policies

In August 2022, the Biden administration announced a one-time federal student loan debt relief program that would eliminate up to $20,000 of federal loan forgiveness for Pell Grant recipients and $10,000 for borrowers who currently earn a qualifying income. However, the Supreme Court invalidated this program on June 30, 2023. This means that borrowers who qualified under Biden’s plan will no longer receive relief.

The current period of forbearance that has been in effect since the onset of the COVID-19 crisis ended on September 1, 2023. However, the Biden administration is implementing a few measures to ease that transition. Read on to find out what that means for you.

When do payments resume?

Repayment restarted on your federal student loans on September 1, 2023. This means that interest has begun to accrue again. The first payment was due in October.

How much will my payments be?

The best way to find out your new monthly payment is to get in touch with your loan servicer. Remember, the federal government uses a variety of loan servicers so you should be sure to find the one you have been assigned. If you were making payments before forbearance, you should already have their contact information. If you are new to making payments, they should have gotten in touch with you via phone, email, or both.

What if I can’t make my payments?

If you cannot currently afford your payments, try getting in touch with your student loan servicer to work out an affordable repayment plan. Additionally, it’s good to note that the Biden administration has implemented a temporary “on-ramp” period for federal borrowers. This period will last for one year.

During this on-ramp period, borrowers will be protected from certain penalties that normally accompany missed, late, or partial loan payments. If you do not submit your payment on time, your credit score will not be hurt, your loans will not go into default, and they will not be sent to collection agencies. That being said, you should make payments if you can afford them. Failing to make a payment can still lead to late fees, and interest will be accruing.

What are the details of the SAVE Plan?

In an effort to make student loan repayment more affordable, Biden has announced a new student loan repayment plan called the SAVE Plan. We don’t have any details on the plan yet but the federal Student Aid website claims it will be the most affordable plan yet.

Is Biden going to try again?

Biden has announced that his administration is going to try again to implement broad student loan forgiveness. They hope to implement through a federal rulemaking policy. It’s important to note that we don’t have any indication that this program will pass.

Additionally, we don’t have any details on how its requirements will vary from the program that was recently struck down. Borrowers who qualified for Biden’s $10,000 or $20,000 programs may not qualify for this one, and vice versa.

As we’ve seen through this example, broad student loan forgiveness is anything but a sure thing. Even though Biden has announced a new plan to pass similar legislation, borrowers should not bank on this passing. Be sure to budget in a way that accommodates your loans well.

So, are my loans going to be forgiven?

Although Biden has announced plans to continue his efforts to implement broad student loan forgiveness, we have no indication that they will come to pass. Even if it does, we no longer have any clues about the eligibility requirements it would have. While the possibility is open for broad loan forgiveness, you should not count on it.

Biden’s previous actions on education financing

Public Service Loan Forgiveness Reform

Public Service Loan Forgiveness is a federal program that began in 2007. The program encourages graduates to pursue a career in public service. Under PSLF, if a borrower with federal loans works for a qualifying employer and makes 10 years of student loan payments–120 total–they will have their remaining loan balance forgiven.

However, the program has been plagued with many technical issues since its start; it has many technical requirements regarding loan type, repayment plan, and employment. As a matter of fact, the program’s acceptance rate between 2007 – 2017 was found to be 1%. In 2018, the TEPSLF was introduced to remedy these issues. In October 2021, Biden introduced several expansions to the TEPSLF, improving accessibility for many applicants.

How did these changes affect borrowers?

The TEPSLF expanded PSLF requirements by allowing payments from all federal loan programs or repayment plans to count toward the 120 payments needed for forgiveness. As long as the borrower worked full-time for a qualifying employer, they will receive credit for all federal student loan payments they made. So, many payments which were previously deemed ineligible became eligible for the program.

What loan types gained eligibility?

Previously, only payments on Direct Loans and Direct Consolidation Loans could count toward the 120 qualifying payments for forgiveness. Payments made on loans from the Federal Family Education Loan (FFEL) program and the Federal Perkins Loan program were not eligible.

Under this temporary program, FFEL payments were eligible, and any loans that gained eligibility by consolidation offered retroactive eligibility to payments made before the consolidation took place. This change will affect payments retroactive to October 1, 2007. The Department of Education estimates that the average borrower could receive 23 additional qualifying payments.

Summary of Biden’s changes

- Under this temporary program, payments made on FFEL and Perkins loans now retroactively counted towards PSLF if you consolidate them

- All payment plans now count towards PSLF, including Graduated and Extended repayment plans, and Standard or fixed repayment plans on terms longer than 10 years

- Time spent on military deferment now counts towards PSLF, even if the borrower made no payments during this time.

- Many borrowers have consolidated their loans in order to gain eligibility for the program. Now, all payments made before their consolidation also qualify as eligible payments.

- Rejected PSLF payments are now eligible for review and audit to be adjusted for the new rules

Source: U.S. Department of Education

This program was temporary

Any borrower who wanted to take advantage of this program had to do it before October 31, 2022. It is possible that the Department of Education will roll out a more comprehensive and long-term solution in the future. However, these rules were only applicable until that date.

Additional targeted forgiveness

In total, even before his August 2022 announcement, Biden had forgiven more student debt than any other president, at a total of over $17 billion. Much of this has come in the form of targeted forgiveness for special cases. Here is a brief summary of the debts he has forgiven so far, and an idea of what this might mean for the future.

Fraudulent institutions

A large portion of these funds have gone to alumni of fraudulent for-profit universities, such as DeVry. For students who paid tuition to attend schools that misled their students about the value of their degree and the quality of their education, these loans can be difficult to pay back. That’s why Biden has focused on forgiving these loans.

If you believe that you have been defrauded by your school, make sure to apply for a Borrower Defense Loan Discharge through the federal government. This way, you’ll be able to take advantage of Biden’s aggressive policy in wiping fraudulent debts.

Permanently disabled students

The Biden administration has also discharged the debts of graduates with a total and permanent disability, as well as veterans with a severe disability. These borrowers have had their slate wiped entirely clean, so there is no need to apply for these programs.

Implications for the future

Biden’s interest in these issues implies that targeted loan cancellation will continue to focus on in his presidency. Situations that render borrowers unable to utilize their degree in order to pay back their loans can be hard to get out of, and it appears that one of Biden’s priorities is to help these people settle their debts. If your situation is similar to any of those described, keep your ear to the ground for any policy changes that could forgive your debt.

Frequently asked questions about the Biden Student Loan Forgiveness Plan

Are student loans forgiven after 10 years?

So, it is very rare for borrowers to have their loans forgiven after 10 years, and those who do abide to a very strict set of guidelines in order to do so.

Should I make student loan payments during the loan freeze?