Student-centric advice and objective recommendations

Higher education has never been more confusing or expensive. Our goal is to help you navigate the very big decisions related to higher ed with objective information and expert advice. Each piece of content on the site is original, based on extensive research, and reviewed by multiple editors, including a subject matter expert. This ensures that all of our content is up-to-date, useful, accurate, and thorough.

Our reviews and recommendations are based on extensive research, testing, and feedback. We may receive commission from links on our website, but that doesn’t affect our editors’ opinions. Our marketing partners don’t review, approve or endorse our editorial content. It’s accurate to the best of our knowledge when posted. You can find a complete list of our partners here.

How to Read a Financial Aid Award Letter (With Examples)

By

Will Geiger

By

Will Geiger

Will Geiger is the co-founder of Scholarships360 and has a decade of experience in college admissions and financial aid. He is a former Senior Assistant Director of Admissions at Kenyon College where he personally reviewed 10,000 admissions applications and essays. Will also managed the Kenyon College merit scholarship program and served on the financial aid appeals committee. He has also worked as an Associate Director of College Counseling at a high school in New Haven, Connecticut. Will earned his master’s in education from the University of Pennsylvania and received his undergraduate degree in history from Wake Forest University.

Full BioLearn about our editorial policies

Bill Jack has over a decade of experience in college admissions and financial aid. Since 2008, he has worked at Colby College, Wesleyan University, University of Maine at Farmington, and Bates College.

Full BioLearn about our editorial policies

Maria Geiger is Director of Content at Scholarships360. She is a former online educational technology instructor and adjunct writing instructor. In addition to education reform, Maria’s interests include viewpoint diversity, blended/flipped learning, digital communication, and integrating media/web tools into the curriculum to better facilitate student engagement. Maria earned both a B.A. and an M.A. in English Literature from Monmouth University, an M. Ed. in Education from Monmouth University, and a Virtual Online Teaching Certificate (VOLT) from the University of Pennsylvania.

Full BioLearn about our editorial policies

If you have applied for financial aid and been accepted to a college, you will receive a financial aid award letter. This award letter is important because it allows students to compare various financial aid packages.

Unfortunately, financial aid award letters can be confusing. Some award letters may not even break down the actual cost of attendance after considering financial aid. On top of all of this, there are no standardized financial aid award letters, so every letter may be a bit different!

That’s why we are here to help you! This way you can compare your financial aid offers and pick the best option.

Jump ahead to:

- What’s in a financial aid award letter?

- How do I compare financial aid awards?

- Examples of financial aid award letters

Also see: Scholarships360’s free scholarship search tool

What’s in a financial aid award letter?

While the formatting and organization of financial aid award letters may vary from letter to letter, there are a few things that are common:

Aid you are awarded

All financial aid award letters will include a list of aid that you were awarded and the actual amount of aid. This is calculated based on your Student Aid Index (SAI) from your FAFSA and/or CSS Profile.

The types of aid you might see on your award letter include:

- Need-based grants including institutional grants, as well as Pell Grants and Federal SEOG Grants. These grants do not need to be repaid.

- Merit-based scholarships that you have been awarded by the institution. You do not need to repay merit scholarships.

- Student loans from the federal government which include Federal Direct Loans and Parent PLUS Loans. While student loans need to be repaid, federal student loans generally have more flexible repayment options and lower interest rates than private student loans.

- Work study which allows students to find and apply for jobs on-campus (but sometimes off-campus) to earn money to contribute towards their education.

Apply to these scholarships due soon

More scholarships for HS seniorsStudent loan information

The student loan section in the award letter can be particularly tricky. A 2018 report from New America analyzed award letters from 455 colleges that included unsubsidized student loans and listed the loans in 136 different ways. In fact, 24 of the award letters didn’t include the word loan at all.

Students should pay close attention to the specific types of student loans in their financial aid package. If there is anything that’s confusing or not clear, they should contact their college’s financial aid office.

This is important because unsubsidized student loans accumulate student loan interest while the student is in college while subsidized student loans do not. This makes these unsubsidized student loans less desirable for students, despite the higher amount of aid they offer in comparison to other loans.

Related: Navigating different types of student loans

Cost of attendance

In addition to the specific types of aid and amounts, the award letter will also have the cost of attendance including tuition, room, board, and other expenses.

It’s important to know that generally this is just the cost for the upcoming academic year and does not include any potential increases in tuition, room, and board. According to research from the Education Data Initiative, there has been a 12% increase in tuition, room and board from 2010-2020, which is an increase of about 2% each year.

Related: Why didn’t I receive financial aid?

Private scholarships

Your financial aid award letter will not include private scholarships that you might win. This is why there is so much upside for students who win private scholarships. And if you were planning on taking out student loans, every dollar in scholarships that you win is money that you won’t have to pay back in loans!

However, be sure to check in with your financial advisor to make sure your outside aid doesn’t over exceed your level of need. If it does, there may be changes to the financial aid your school offers you.

@scholarships360 Even though FAFSA has been behind schedule this year, here’s a guide on how to read a financial award letter, so youll be all ready when you recieve yours! If you have multiple letters to compare, check out our free comparison tool! https://scholarships360.org/financial-aid/award-letter-comparison-tool/ #scholarships360 #scholarship #FAFSA #awardletter #howto #student #education #highschool #college

♬ Aesthetic – Gaspar

How do I compare financial aid award letters?

Once you have all of your award letters available, you’ll want to compare the data to see how the various awards stack up. The best way to do this is by viewing and analyzing the data in the same place. The Illinois Student Assistance Commission has a free comparison tool that includes all of the most important data fields. You can also do this yourself in a spreadsheet.

We also offer our own financial aid award comparison tool! Be sure to check it out while you’re on our website.

The most important aspect of comparison is to compare the net price of the college or the cost after taking financial aid into account. You’ll want to put student loans in their own category because you will have to pay them back. This also allows you to understand what your total debt load will look like after four years of college.

Related: Developing a student loan repayment plan

Financial aid award letter examples

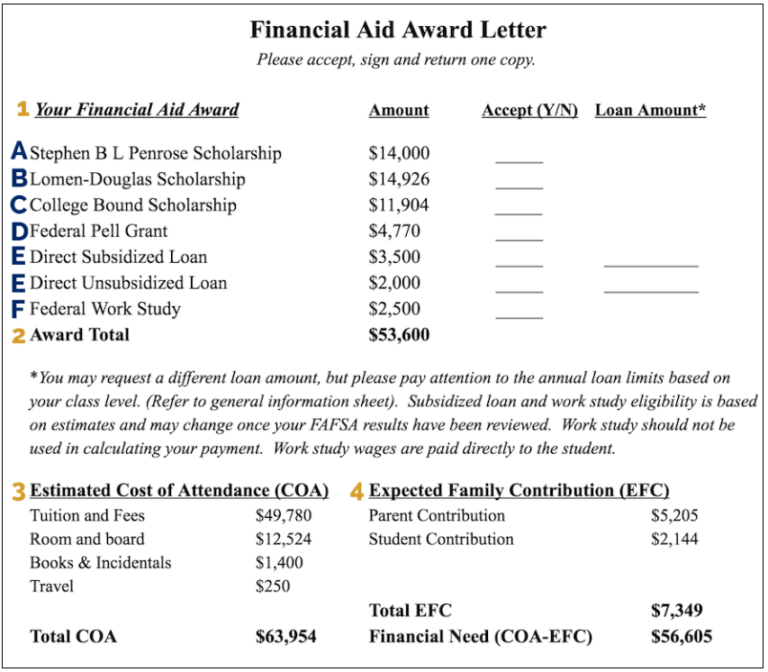

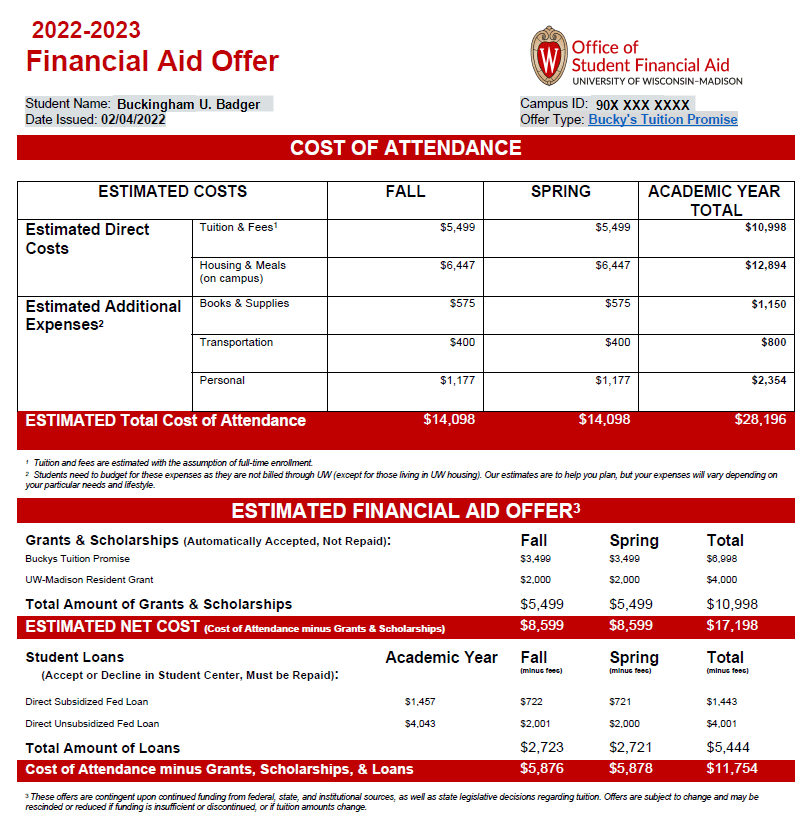

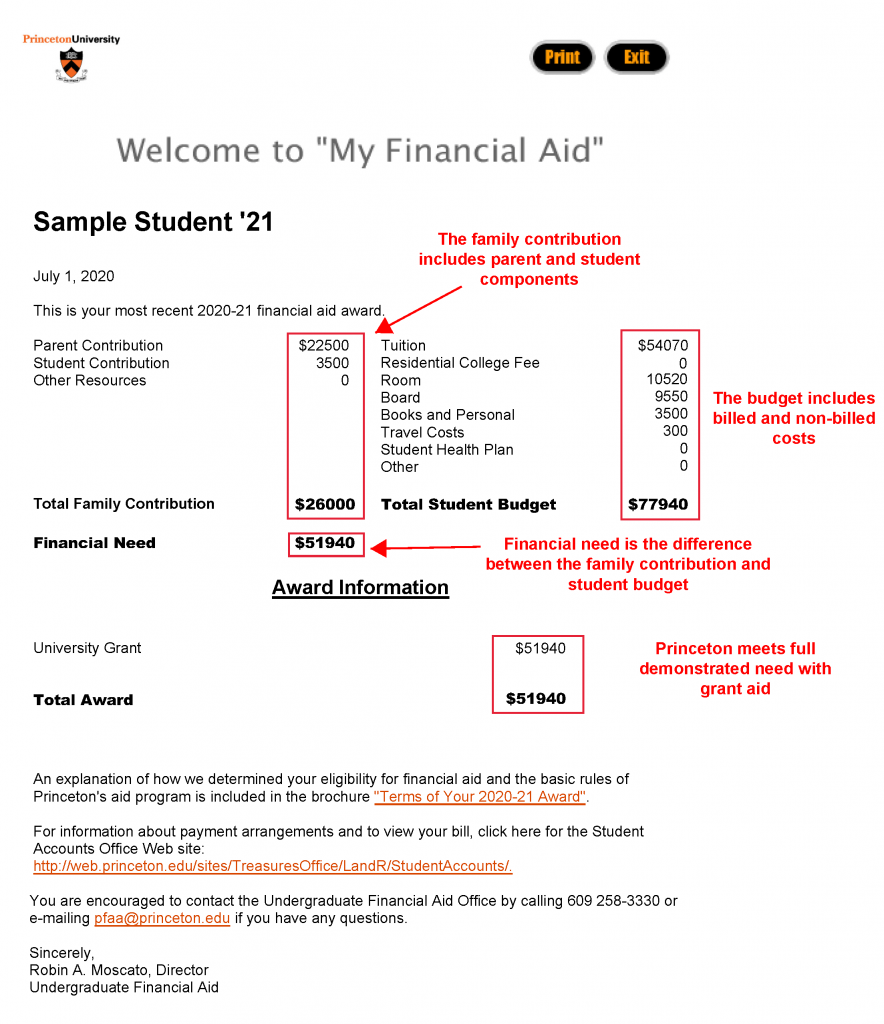

Next, we will examine a few different financial aid award letter examples to show you what an award letter might look like. Specifically, we will be reviewing letters from a private college (Whitman College), a large public university (University of Wisconsin), and an Ivy League university (Princeton University).

Jump ahead to:

Whitman College (Walla Walla, WA)

This award letter includes three different scholarships, a Federal Pell Grant, and clearly distinguishes between the Direct Subsidized and Unsubsidized student loans. You will notice that you don’t need to accept the loan portion of the financial aid package and also have the option to take out less money in student loans.

After taking into account all of the financial aid, this family is responsible for $7,349. If the student chose not to take out Federal student loans, the family contribution would increase to $12,849.

University of Wisconsin (Madison, WI)

This financial aid offer from the University of Wisconsin looks quite a bit different from the letter from Whitman College. Notably, UW breaks down the award letter per semester, but also gives the yearly totals.

A few other things to point out:

- Differences in student loan terminology and amounts compared to Whitman College.

- The University of Wisconsin also includes $2,500 in personal expenses as part of the cost of attendance. In contrast, Whitman doesn’t factor this into their letter.

- Total cost of attendance isn’t everything. UW has a cost of attendance that’s less than half of Whitman College ($32,132 vs. $63,954), but the actual cost for this student would be more: $14,056 vs. $7,349. Plus, the UW package includes more student debt.

Related: Why didn’t I receive any financial aid?

Princeton University (Princeton, NJ)

This letter from Princeton includes some annotations that are for educational purposes only. These annotations won’t be on your actual aid award letter. However, we see yet another example of a financial aid award letter.

Unlike the other award letters we do not see any mention of student loans. This is because Princeton includes only need-based grants and not merit scholarships or student loans in their financial aid packages.

Related: How to write a financial aid appeal letter (with example)

Frequently asked questions about how to read a financial aid letter

When will I receive my financial aid award letter?

How do I check my financial aid award?

Can I have too much financial aid?

Oftentimes, the federal student aid and/or your overall aid package might be reduced to compensate. In other cases, some students receive the amount leftover to spend on things like school supplies, living expenses, and more.