Student-centric advice and objective recommendations

Higher education has never been more confusing or expensive. Our goal is to help you navigate the very big decisions related to higher ed with objective information and expert advice. Each piece of content on the site is original, based on extensive research, and reviewed by multiple editors, including a subject matter expert. This ensures that all of our content is up-to-date, useful, accurate, and thorough.

Our reviews and recommendations are based on extensive research, testing, and feedback. We may receive commission from links on our website, but that doesn’t affect our editors’ opinions. Our marketing partners don’t review, approve or endorse our editorial content. It’s accurate to the best of our knowledge when posted. You can find a complete list of our partners here.

Everything You Need to Know About Work Study

By

Will Geiger

By

Will Geiger

Will Geiger is the co-founder of Scholarships360 and has a decade of experience in college admissions and financial aid. He is a former Senior Assistant Director of Admissions at Kenyon College where he personally reviewed 10,000 admissions applications and essays. Will also managed the Kenyon College merit scholarship program and served on the financial aid appeals committee. He has also worked as an Associate Director of College Counseling at a high school in New Haven, Connecticut. Will earned his master’s in education from the University of Pennsylvania and received his undergraduate degree in history from Wake Forest University.

Full BioLearn about our editorial policies

Bill Jack has over a decade of experience in college admissions and financial aid. Since 2008, he has worked at Colby College, Wesleyan University, University of Maine at Farmington, and Bates College.

Full BioLearn about our editorial policies

Maria Geiger is Director of Content at Scholarships360. She is a former online educational technology instructor and adjunct writing instructor. In addition to education reform, Maria’s interests include viewpoint diversity, blended/flipped learning, digital communication, and integrating media/web tools into the curriculum to better facilitate student engagement. Maria earned both a B.A. and an M.A. in English Literature from Monmouth University, an M. Ed. in Education from Monmouth University, and a Virtual Online Teaching Certificate (VOLT) from the University of Pennsylvania.

Full BioLearn about our editorial policies

Federal work study is a program that helps college students with demonstrated financial need get part-time jobs to pay for their college education and related expenses.

Work study can be funded by the Federal government, as well as specific states. Generally, the part-time jobs that students receive from work study are for on-campus jobs, but in certain situations students might work off-campus.

Don’t miss: Scholarships360’s free scholarship search tool

In this guide, you’ll learn everything you need to know about work study including:

- How do you apply for work study?

- How much does work study pay?

- How many hours per week will I have to work?

- What if you don’t qualify for work study?

- Frequently asked questions

How do you apply for Federal work-study?

Work-study is a federally and sometimes state-funded program, so to qualify, students must submit the FAFSA and qualify for need-based financial aid.

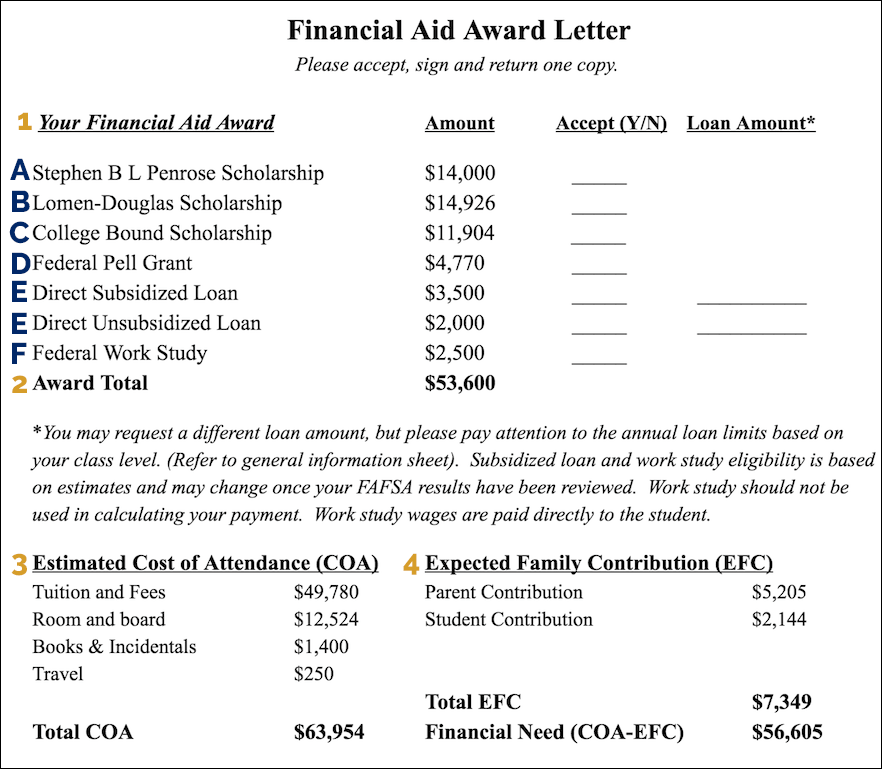

Once you are accepted to the college, you will receive a financial aid award letter that will include specifics about your financial aid. Work study is one of the funding types that could be included in your letter if you qualify.

In the financial aid award letter below, you will see Federal Work Study as item F:

Note that the formatting of financial aid award letters will vary from college to college.

Accepting Federal Work Study

Just receiving a work study offer in your aid letter does not guarantee that you will simply receive the funds. Next, you will need to actually find a job! While some colleges may match students to specific jobs, it is usually up to students to find, apply, and accept a job opportunity.

We recommend that you get in touch with your college’s financial aid office for more details about how the work study process works!

Similar to other forms like financial aid like student loans, students do not have to automatically accept their work study. However, as students will be gaining valuable work experience and earning some money, work study is preferable to student loans.

Another benefit of federal work study is that your earnings will not count against you when you apply for financial aid through the FAFSA for the following year (as long as they are used to pay for educational expenses like tuition, room, or board). If a student deposits their work study earnings into their bank account, this will be factored into the financial aid office’s review for aid the following year.

How much does work study pay?

According to a 2022 report from Sallie Mae, the average Federal Work Study recipient earned $1,531. As far as hourly rate, your work study job must pay the federal minimum wage. Of course, you might be attending school in a state or city where the minimum wage is higher.

It is also important to note that some work study jobs may pay more or less than others depending on the specific responsibilities of the position.

Related: Is work study worth it?

Is there a maximum amount of money I can earn?

Your annual federal work study wages can’t exceed the amount listed on the award letter. However, in practice it is up to the individual colleges or work study employers to determine what happens if a student wants to keep working after they have reached their limit. So if you are a student who wants to work more, you should contact your financial aid office and work study employer for more information.

What if you don’t qualify for work study?

If you don’t qualify for or receive work study, you can still apply for on-campus and off-campus jobs! We recommend that you still get in touch with the financial aid office, because that’s where student employment is usually managed.

Other places to look for jobs include the office of residential life, tutoring or academic services, and specific academic departments. Of course, you are able to find and apply for other jobs and internships that are off-campus!

Related: What to do if financial aid is not enough

Additional resources for students seeking financial aid

As you’re considering work-study, make sure that you’re also aware of all your other financial aid options. Students eligible for work-study also typically qualify for Pell Grants and Stafford Loans. You can also consult our free scholarship search tool to find custom-matched, vetted scholarship opportunities to suit your situation and interests.

Sometimes, even with all of these resources, the financial aid package a school offers you is just not affordable. In cases such as these, it’s a good idea to consider writing a financial aid appeal letter. If the financial aid officers overlooked something or your finances have changed since submitting the FAFSA, you may manage to adjust your aid.

Also see: Are work study earnings taxed?

Frequently asked questions about work study

How many hours a week can I work in a work-study job?

What types of jobs are available through work-study?

Can international students participate in work-study programs?

Will work-study affect my financial aid package?

What should I do if I have a work-study job, but struggle to balance it with my academics?