Student-centric advice and objective recommendations

Higher education has never been more confusing or expensive. Our goal is to help you navigate the very big decisions related to higher ed with objective information and expert advice. Each piece of content on the site is original, based on extensive research, and reviewed by multiple editors, including a subject matter expert. This ensures that all of our content is up-to-date, useful, accurate, and thorough.

Our reviews and recommendations are based on extensive research, testing, and feedback. We may receive commission from links on our website, but that doesn’t affect our editors’ opinions. Our marketing partners don’t review, approve or endorse our editorial content. It’s accurate to the best of our knowledge when posted. You can find a complete list of our partners here.

What is a Master Promissory Note?

By

Will Geiger

By

Will Geiger

Will Geiger is the co-founder of Scholarships360 and has a decade of experience in college admissions and financial aid. He is a former Senior Assistant Director of Admissions at Kenyon College where he personally reviewed 10,000 admissions applications and essays. Will also managed the Kenyon College merit scholarship program and served on the financial aid appeals committee. He has also worked as an Associate Director of College Counseling at a high school in New Haven, Connecticut. Will earned his master’s in education from the University of Pennsylvania and received his undergraduate degree in history from Wake Forest University.

Full BioLearn about our editorial policies

If you are like most students, you will be paying for college in a number of ways. Scholarships, savings, and need-based grants are a few of the most common ways students pay for college. Student loans are another way that students will fund their education. According to a 2023 research report from Sallie Mae, 19% of students borrowed student loans to pay for college.

Federal student loans are generally the first type of student loans that students will turn to in order to fund their education. After you apply for financial aid with the FAFSA and are awarded student loans, you will come across the Master Promissory Note (MPN).

Don’t miss: Scholarships360’s free scholarship search tool

Master Promissory Note

Most students and parents will just skim over the MPN, but it is important to know what you are signing off on! The Master Promissory Note is important, because it is the legal document that says you promise to repay your loans, interest, and any associated fees to the United States Department of Education.

The Master Promissory Note will also outline the specifics of what you owe, the interest rates, late fees, repayment options, deferment options, and cancellation options.

When you sign your name to the MPN, you are agreeing to pay back the loans no matter what. Here are a few situations where students will still be responsible for paying back their student loans:

- If you decide to withdraw from college and don’t earn a degree, you will still be responsible for paying back the student loans that you have taken out.

- If you graduate from college or grad school and can’t find a job, you are still responsible for paying back the student loans.

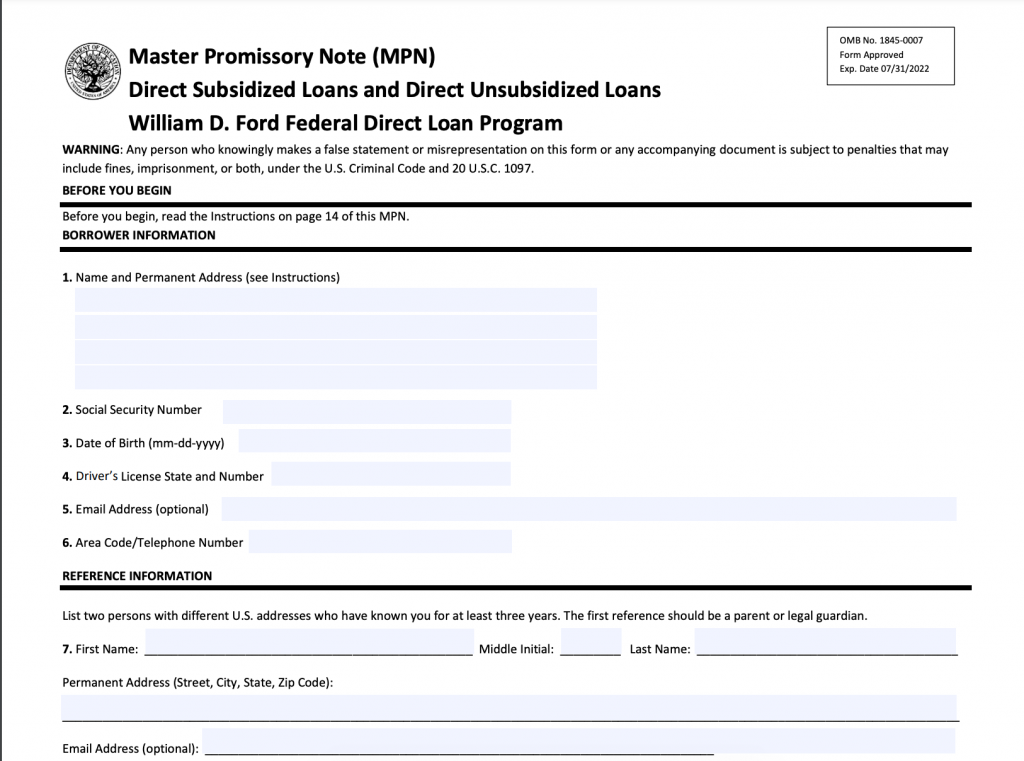

Sample Master Promissory Note

Here is a sample MPN:

This Master Promissory Note is a final step to securing and accessing a loan from the United States Department of Education including Direct Student Loans (also known as Federal Stafford Student Loans) and Direct PLUS loans. Keep on reading to learn everything that you need to know about MPNs.

Types of Master Promissory Notes

There are three types of MPNs:

- Undergraduate Students who are taking out Direct Subsidized Loans or Direct Unsubsidized Loans.

- Graduate Students who are taking out Direct Unsubsidized Loans, Direct PLUS Loans, or both.

- Parents who are taking out PLUS Loans for their child’s undergraduate education.

When do you sign a MPN?

According to the U.S. Department of Education, all borrowers need to complete an MPN before they can receive a federal student loan.

Related: FAFSA guide for grad students

How to sign the MPN

When you are reading to complete the Master Promissory Note, you can do so in two ways: sign a paper copy or sign the electronic version. The Department of Education estimates that the process of reviewing and signing the Master Promissory Note takes about 30 minutes.

Note that you will need your Federal Student Aid (FSA) ID to complete your MPN.

The following links will include both the electronic version of the MPS and the PDF version that you can sign:

Questions about the Master Promissory Note?

If you have questions about the MPN, you can contact the Federal Student Aid Office at the Department of Education. Here, you can get support via phone, live chat, and email.

Don’t miss: How to complete the FAFSA

Frequently asked questions about the Master Promissory Note

How long is a MPN good for?

How do I get a copy of my Master Promissory Note?

Are Master Promissory Notes legally binding?

Do I need a witness to sign my MPN?